- Call for Consultation: 212-843-4059 Tap Here to Call Us

New Yorkers are Falling off a Cliff

An applicable credit is allowed against the New York state estate tax when a New York taxable estate is not greater than 105% of the Basic Exclusion Amount.

The Basic Exclusion Amount in 2019 is $5,740,000.

POINT 1 – If the New York taxable estate is less than or equal to the basic exclusion amount, the applicable credit amount will be the amount of tax that is computed on the taxable estate.

POINT 2 – The applicable credit is phased out as the New York taxable estate approaches 105% of the basic exclusion amount. If the New York taxable estate is greater than the basic exclusion amount but not greater than 105% of the basic exclusion amount, then the applicable credit is equal to the estate tax that would be due on an amount computed by multiplying the basic exclusion amount by one minus a fraction. The numerator of the fraction equals the New York taxable estate minus the basic exclusion amount, and the denominator equals five percent of the basic exclusion amount.

POINT 3 – Thus, if the value of an estate exceeds the exemption amount by more than 105%, the exemption is lost (in effect disappears) and taxes on the full value of the estate are due.

EXAMPLE: John died in 2019 with a taxable estate of $5,740,000. Since he is not over the New York state exemption amount, there is zero New York state estate tax due and $5,740,000 will pass to his heirs New York State estate tax free. On the other hand If John died in 2019 with a taxable estate of $5,900,000, he would exceed the New York state exemption amount by $160,000. In this case there would be a New York state estate tax due of $356,800, leaving $5,543,200 to pass to his heirs. Because of the cliff, John’s heirs would inherit $196,800 less, even though John’s taxable estate was $160,000 more! The tax rate on the $160,000 increment is 223%.

What to do? The Effect of Lifetime Gifts.

Families who are potentially subject to eventual state or federal estate taxation should become acquainted with the significant transfer tax savings, which can be achieved through lifetime gifts to children, grandchildren and others.

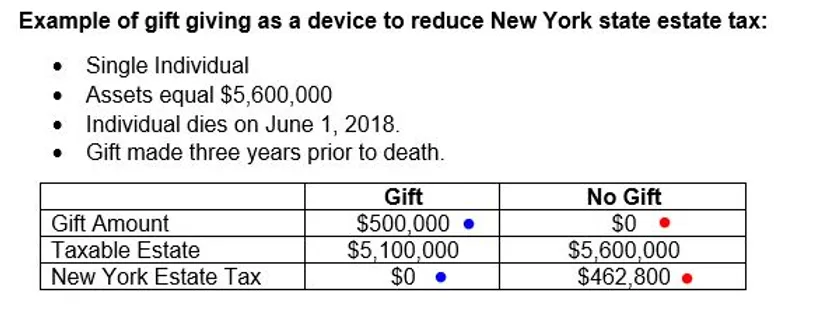

Because New York state has no gift tax, and only adds back to the gross estate gifts made within three years of death, New York residents should consider lifetime giving as a tool to shelter gifted property from New York estate tax and avoidance of the “cliff.”

Robert Adler, Esq. is an attorney who focuses his practice on wills, trusts and estates. He can be reached at 212-843-4059 or 646-946-8327.