- Call for Consultation: 212-843-4059 Tap Here to Call Us

Estate Planning Flowcharts – Six Common Structures for Affluent Families

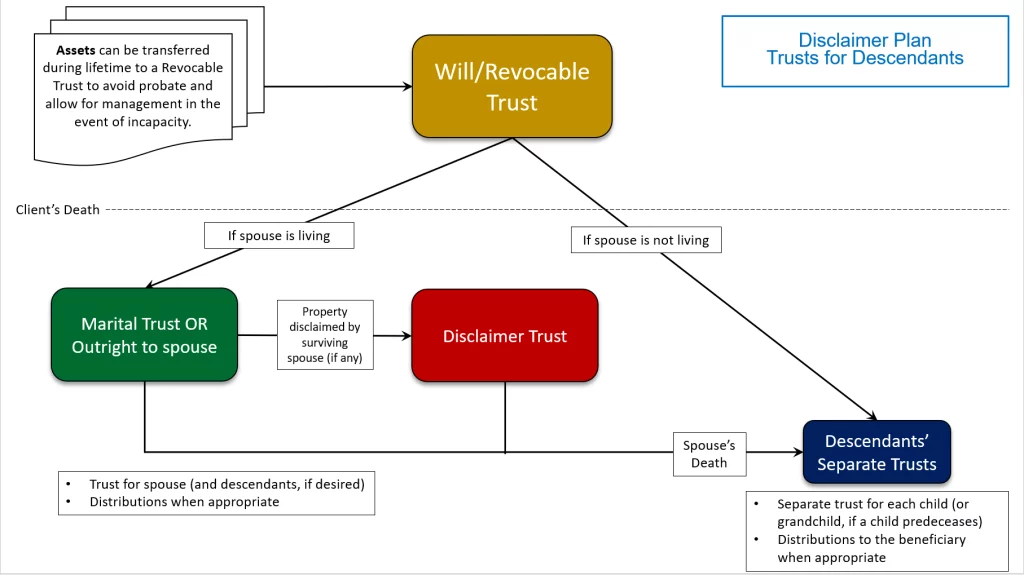

1 – Disclaimer Plan With Trusts For Descendents

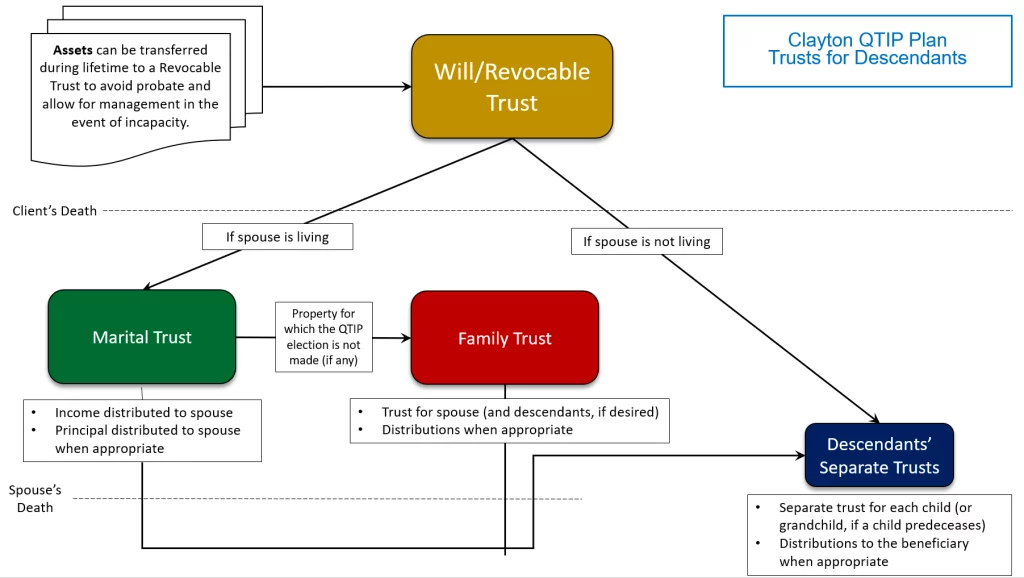

2 – Clayton QTIP Plan With Trusts for Descendants

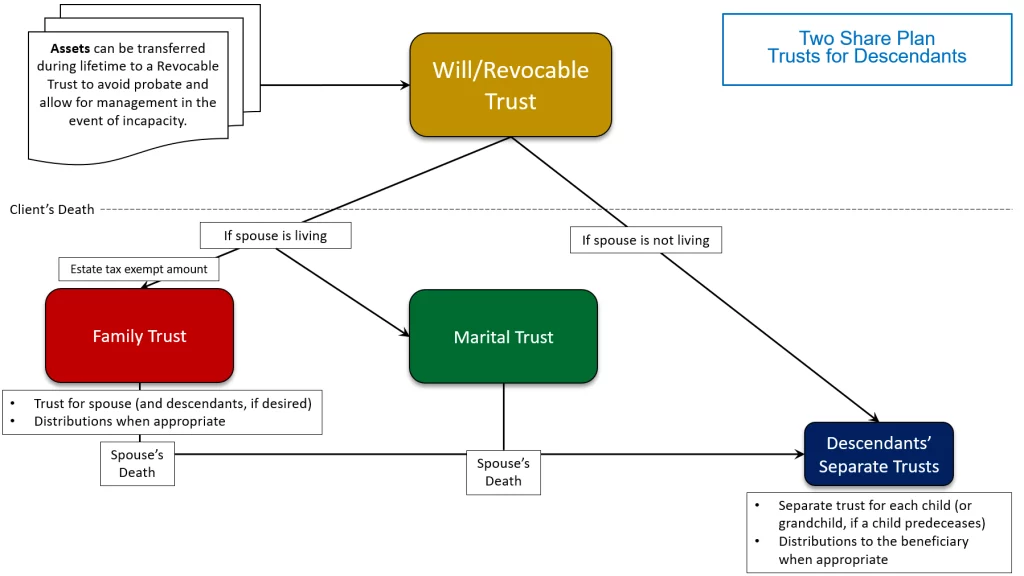

3 – Two Share Plan With Trusts for Descendants

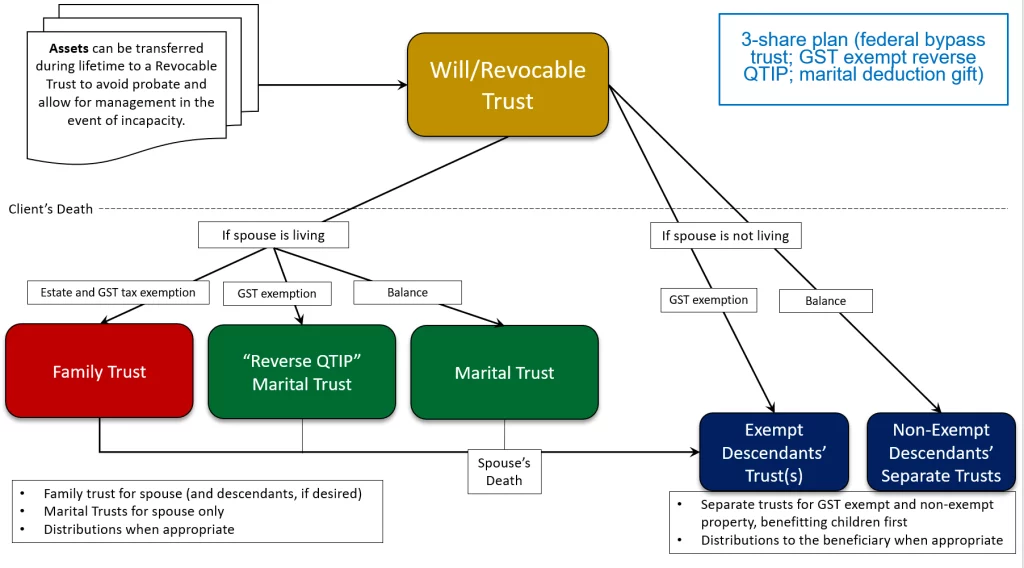

4 – Three Share Plan (Federal Bypass Trust (Family Trust); GST Exempt Reverse QTIP Marital Trust; Marital Trust)

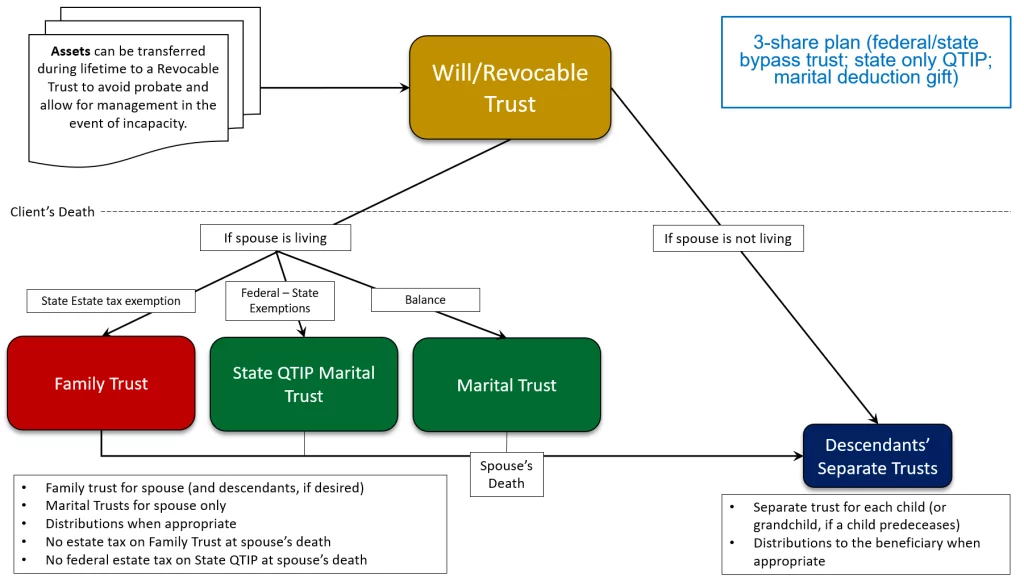

5. Three Share Plan (Federal/State Bypass Trust (Family Trust); State Only QTIP Marital Trust; Marital Trust)

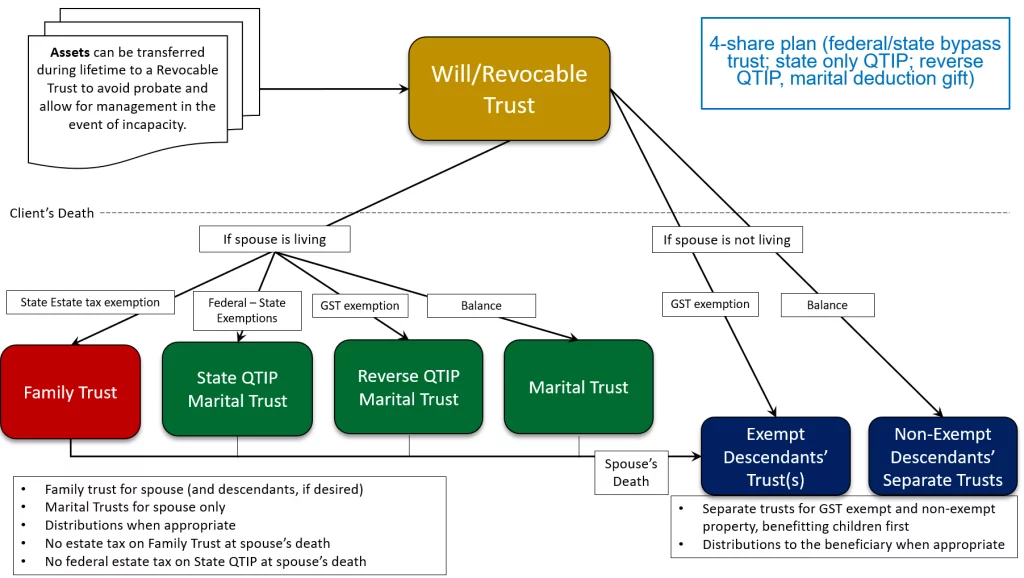

6 – Four Share Plan (Federal/State Bypass Trust (Family Trust); State Only QTIP Marital Trust; Reverse QTIP Marital Trust, Marital Trust)

Clarity begins with a conversation. Call: 212-843-4059 or 646-946-8327.

Wills and Trusts, Estate Planning: Steps, Costs and Our Process