Wills & Trusts

Estate Administration

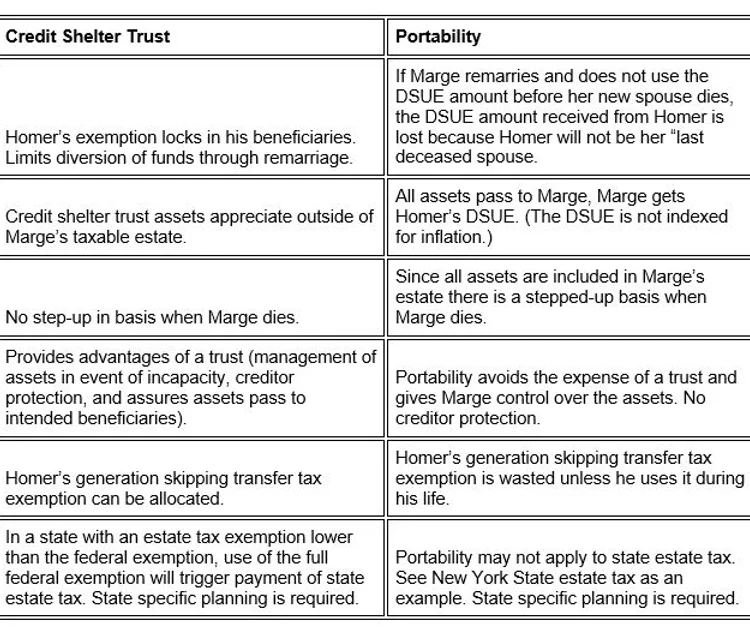

The American Taxpayer Relief Act of 2012 (ATRA) made permanent the portability of estate tax exemption between spouses. Under portability, if the first spouse to die does not use his or her exemption from estate and gift tax, the executor of the first spouse’s estate may elect to give the use of the remaining exemption amount to the surviving spouse — the so-called deceased spousal unused exemption amount, or DSUE. For decades, the basic estate plan for married couples with assets over the then applicable exemption amount has been the credit shelter trust / marital trust plan. All these plans need to be reviewed. For some, the credit shelter trust will still make sense… for others, portability will be the better option.

Homer and Marge’s Portability Cheat Sheet (Assumes Homer Dies First)

New York State does not recognize portability of a deceased spouse’s unused New York State estate tax exemption to the surviving spouse as the Federal law does. See: Credit Shelter Trust Planning