Wills & Trusts

Estate Administration

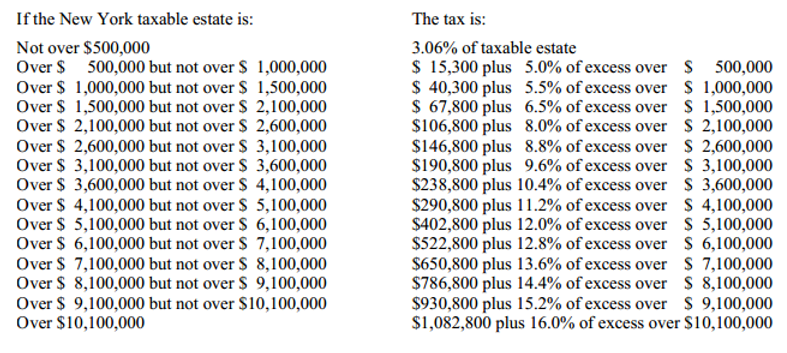

The estate tax is computed based on the New York taxable estate of a resident or nonresident using the following tax table:

The basic exclusion amount is used to determine the estate’s filing threshold and also to determine the amount of the applicable credit (if any). The Basic Exclusion Amount in 2023 is $6,580,000.

WARNING: The applicable credit is phased out as the New York taxable estate approaches 105% of the basic exclusion amount. See: The Cliff