Wills & Trusts

Estate Administration

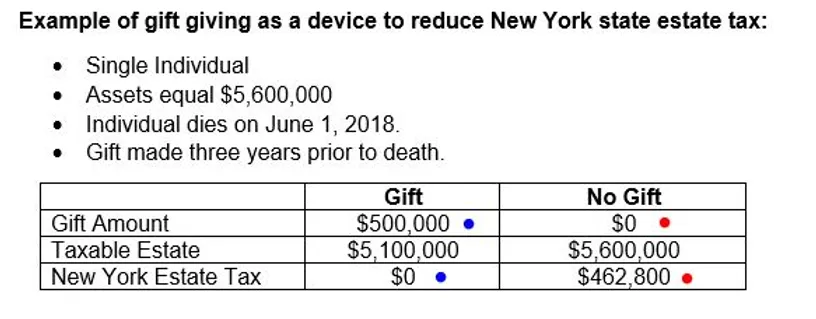

Families who are potentially subject to eventual state or federal estate taxation should become acquainted with the significant transfer tax savings, which can be achieved through lifetime gifts to children, grandchildren and others.

Because New York State has no gift tax, and only adds back to the gross estate gifts made within three years of death, New York residents should consider lifetime giving as a tool to shelter gifted property from New York estate tax and avoidance of the “cliff.”